The first step in smart budgeting is gaining a clear picture of how much money comes in and where it goes. By tracking income and expenses, you can identify patterns that reveal unnecessary spending habits. This awareness allows you to prioritize needs over wants and make adjustments where necessary. Without a proper understanding of your financial flow, it becomes difficult to plan effectively or make room for savings. Clarity forms the foundation of a reliable budget.

Setting Realistic Financial Goals

A strong budget is not just about cutting costs but about working toward meaningful goals. These can include building an emergency fund, paying off debt, saving for a vacation, or preparing for long-term investments. Setting clear, realistic goals helps you stay motivated and disciplined in your financial decisions. When your spending is aligned with your objectives, every dollar works with purpose, making budgeting less about restriction and more about achieving financial freedom.

Prioritizing Essential Expenses

Once goals are defined, it is important to prioritize essential expenses such as housing, food, utilities, and transportation. These needs should always come before discretionary spending. By ensuring that necessities are covered first, you create a stable financial base that protects against unexpected challenges. This approach reduces stress and prevents financial shortfalls that can arise when non-essential expenses are given more attention than they deserve. Essentials act as anchors that hold your budget steady.

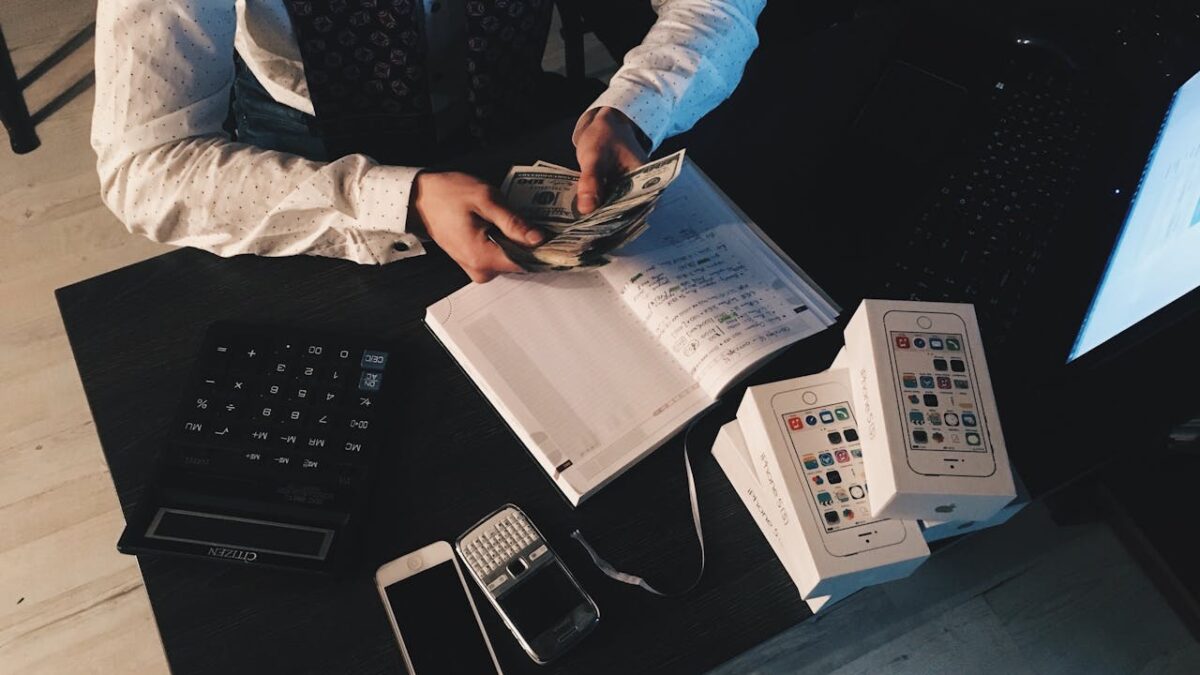

Using Tools to Stay on Track

Technology has made budgeting easier and more efficient. Apps and digital tools allow you to track expenses in real time, set spending limits, and receive alerts when you are close to overspending. Many platforms also categorize spending, helping you understand exactly where your money goes each month. By using these tools, you stay accountable and make budgeting a consistent habit rather than a sporadic task. The convenience of technology transforms budgeting into an accessible and manageable routine.

Building Flexibility into Your Budget

A smart budget is not rigid but adaptable to life’s changes. Unexpected expenses, opportunities, or emergencies can disrupt even the most carefully planned budget. By leaving room for flexibility, you can adjust without losing control of your finances. This might mean setting aside a small buffer each month for unplanned costs or re-evaluating your budget when your income changes. Flexibility ensures that your budget works with your life rather than against it, making financial stability sustainable over the long term.